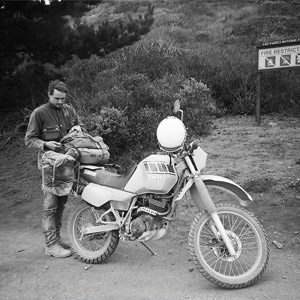

Photo: Scott Olivet, former CEO at Oakley.

Billabong has a future! Although it will be one that’s a little different than what they planned. Altamont Capital have partnered with Blackstone to offer up a $325 million bridging debt facility. In addition, the Bong will get with a further $70 million to come from the sale of DaKine to Altamont. In return, Altamont will get 12% interest on the loan over the year that it runs and will get up to 42 million options over Billabong shares. If they excersise those options, they would have between 36.3 per cent and 40.5 percent of the company.

Billabong will be using the cash to repay $289 million in debt. And the other $106 million will keep the whole ship afloat while they pull together some longer term funding options and try to get it headed in the right direction.

In addition, the deal sees current CEO Laura Inman exit after 14 months in the job. She says that she’s always known the Altamont deal would mean she was leaving. In her place will be former Oakley CEO, Scott Olivet, who will be running the company from California rather than at the Gold Coast HQ. I don’t know much about him except that when I Googled his name for an image, I got a bunch of photos of him with tanks and other military equipment. In my book, that makes him awesome and gives me confidence.

This news is all over everywhere this morning but here’s a few more in-depth articles if you want to know more.

Billabong deal gives US fund Altamont control, CEO Launa Inman out – The Australian

Billabong CEO ousted as Altamont throws debt lifeline – Business Spectator

Launa Inman makes way for Scott Olivet as Billabong finds a debt solution – BRW