Investor Jeremy Raper: Raper Capital has written an indepth piece on the likely outcomes for Quiksilver based on the most recent earnings call. Gazing through his well-researched-crystal-ball, things aren’t looking so good.

If you’re interested, you really need to read the whole thing. This is the first analysis I’ve read that acknowledges some of the bigger issues the brand is facing. Perhaps without explicitly spelling out how much the label (along with its peers) are on the nose at the moment, but definitely citing that lack of investment in their athletes and marketing that has driven a decline in the value consumers see in the brand.

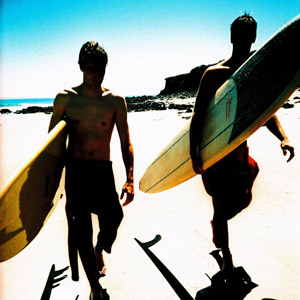

Quiksilver always benefited from a ripple effect – the core participants loved a surfer or product that had the brand on it, those people were cool and influenced a wider audience. When the brand shifted focus to sell to that wider audience, they lost their aspirational pull. Combined with the shift to brandless, cheaper and faster fashion that wasn’t reacted to by the surf labels… creek, paddle, etc.

Where things get really interesting is at the math around how the company’s position, cash burn rate and conditions on its loans mean it is headed towards one of three solutions in the next three quarters;

– Penalty terms from the lenders for breaching their agreements,

– A sale of one of the brands,

– Bankruptcy/Restructure.

Rapers prediction is that a combination of the first two is the most likely option as banks are reluctant to press the third. But when you look at both the recent history of the brand combined with the predictions made here, a wind-up sooner rather than later actually provides a greater return at lower risk to the primary lenders. Something to ponder.

If you have any interest in this at all, go read the full thing here: Quiksilver Update: After The Wipe-Out, Not Much Left For Shareholders